SUP RETIREMENT BENEFITS AND RESOURCES

This page will provide a broad overview of the retirement benefits available to SUP members. It will also include some resources, links, literature, and tools for further retirement education and analysis.

SUP Retirement Plans include the SIU-PD Pension Plan, the SUP Money Purchase Pension Plan, and the SUP 401(k) Plan. The SIU-PD Pension Plan is a traditional defined benefit pension plan that is earned based on work history and pay as long as you live. There is a Joint Survivor Annuity Benefit option that makes the pension also available to your spouse, should you elect that option.

The Money Purchase Plan and the 401(k) Plan are self-directed defined contribution plans that allocate before tax income to your own account. The Money Purchase Plan contributions are automatic and built into the contract and although they are part of overall compensation and the collectively bargained economic package, they are also made separate from wages. SUP 401(k) contributions on the other hand are made entirely from wages according to your designated percentage amount, or not at all depending on your preference.

RETIREMENT CHECKLIST

The SUP Welfare Plan has prepared a "To Do" checklist of common issues that confront members nearing retirement. Before you actually retire, be sure to check out the preparation checklist to make sure everything is in place. SUP Retirement Checklist

PENSION BENEFIT OVERVIEW

A short description of the Pension Benefit is available at SIU Pacific District Pension Notes. The Notes outline the different types of Pensions available, how eligibility credits for benefits are earned, how benefits vest, breaks in service rules, and how the SUP Pension Benefit integrates with other pensions that have agreements with the Plan.

The SUP Retirement Manager's website, including access you your SUP Money Purchase Plan and SUP 401(k) Plan can be accessed at The Standard.

RETIREMENT MATERIALS FROM STANDARD

The following items may be helpful for specific issues around retirement planning and investments.

Start now. Small savings over time add up. See Small Savings Increase: Big Difference and It Pays to Increase Your Savings Rate and Are you saving enough? Savings Workbook and Get Ready for Retirement the Easy Way.

Understanding the basic asset classes is an important part of building a retirement portfolio. Here's a start: Cash Bonds or Stocks -- What's the difference?

SOCIAL SECURITY FAQ'S FROM SCHWAB

The national Social Security benefit is a important component of any retirement income plan. Social Security was intended as a minimum "safety net" benefit for American workers, and seeing it as a part of the plan rather than the entire solution, is a wise approach. First, it is important to understand the benefit and the strategies around collection as a basic building block for a successful retirement. These Frequently Asked Questions may be helpful.

1. Who’s eligible to receive Social Security benefits?

To qualify for Social Security, you or your spouse need to have paid the Social Security payroll tax for at least 10 years (though those years needn’t be consecutive). A nonworking spouse is potentially entitled up to half of a spouse’s benefit.

2. How are benefits calculated?

There are two formulas at work behind the scenes. One that is based on your 35 highest-earning years indexed for inflation and another that transforms that calculation into the monthly benefit estimates we understand — bottom line, the more you earn over your lifetime, the more you can expect to receive from Social Security.

That said, there’s a limit to the amount of annual income that qualifies for the Social Security calculation. (In 2021, it’s $142,800.) However, if you earn more than the annual maximum in a given year as an employee, the income above that threshold will not be subject to the 6.2% Social Security payroll tax (for the self-employed the rate is 12.4%).

3. How can I increase my benefit?

Although there’s nothing you can do to revise your earnings history, there are other steps you can take to boost your Social Security payouts.

Work longer: If you don’t yet have 35 years of income history, every additional year you work replaces a zero-income year. And if you’re currently earning your peak income, every additional year you work could replace a year in which your earnings were lower.

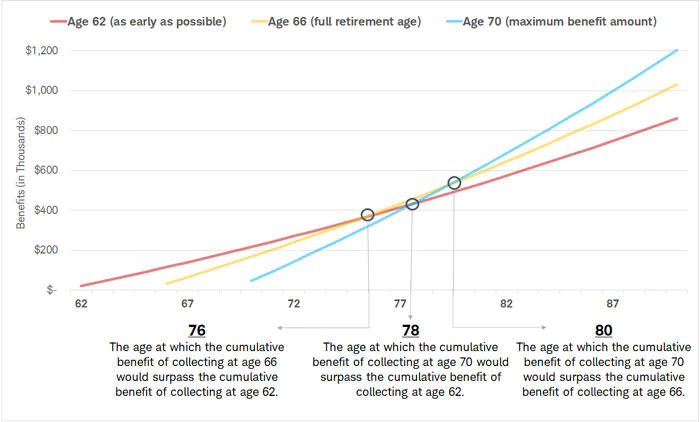

Wait to collect: Although you can start collecting a reduced benefit as early as 62, waiting to collect will boost your monthly check. Indeed, for every year you delay past your full retirement age—which is between 66 and 67, depending on your birth year—you’ll see a boost in your annual payout of about 8%. Thus, if you wait to collect until 70, after which there is no incremental benefit, you’ll receive from 24% to 32% more than if you had begun collecting at your full retirement age—and roughly 76% more than if you had begun collecting at 62.

Of course, it’s not always possible to work longer or wait to collect. Those in poor health or who need the income to make ends meet, for example, might decide to take Social Security as soon as possible.

4. What’s a good strategy for spouses?

A lot of couples want to start collecting both spouses’ Social Security right away, but doing so may not be the best choice if one of you earned significantly more than the other over the course of your working careers. Although there’s no magic bullet, it often makes sense for the higher earning spouse to wait as long as possible, up to age 70. Depending on health and finances, the lower-earning spouse can collect benefits earlier.

This is especially beneficial from an estate-planning perspective. That’s because after the death of one spouse—regardless of whether it was the lower- or higher-earning one—the surviving spouse receives the larger of the two benefits for the remainder of his or her lifetime.

“I often suggest that clients think through a worst-case scenario in which one of the two checks goes away,” says Nancy Cresswell, an associate financial planner at Schwab Private Client Investment Advisory. “How much of a difference might it make for the surviving spouse, having maximized the benefit?”

There are other strategies to consider, of course. If you need help, it’s best to consult a qualified financial planner or National Social Security Advisor before filing for benefits.

When waiting pays off: For those who live to age 76 or older, waiting to collect Social Security can be rewarding. But remember, Social Security isn’t just an investment or a break-even analysis. It’s a form of insurance, to protect you by providing income – which will be higher, the longer you wait – if you live past the break-even date.

Source: SSA.gov. Hypothetical benefits assume the retiree was age 62 in 2012, age 66 in 2017 and age 70 in 2021, and began collecting benefits in January of each year. Benefits increase by 1.99% annually to account for inflation.

5. Can my kids inherit my Social Security benefit?

It’s not just a spouse who can benefit from the Social Security you’ve earned. Dependent children and even grandchildren may also be eligible if they are under 18 when the Social Security recipient dies, becomes disabled, or retires. And disabled children of any age may qualify if they were disabled before the age of 22. That said, “the rules are complicated, especially around disability,” cautions Rob Williams, CFP® and vice president of financial planning and retirement income at the Schwab Center for Financial Research. As a result, Rob recommends consulting the appropriate benefit specialists at the Social Security Administration (SSA).

6. Is Social Security going to run out of money?

According to the SSA, the surplus in the two Social Security trust funds—the Old-Age and Survivors Insurance Trust Fund, which pays retirement and survivors benefits, and the Disability Insurance Trust Fund, which pays disability benefits—will be exhausted between 2033 and 2035, all things being equal.

However, “exhausted” is a relative term. The SSA says some benefits could be paid even if the trust funds are depleted. In fact, the trust funds’ annual income is projected to equal about 79% of the program’s cost even if the reserves were fully depleted.

There could be later retirement dates or lower benefits. On the other hand, if changes were made to the law everything could look completely different. For example, merely raising the income cap on Social Security deductions would likely fix any problems for the forseeable future.

Source: Schwab Center for Financial Research

Important Disclosures

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.